A senior man uses his laptop to check his credit score and plan improvements. Improving a credit score quickly requires focus and discipline, but it is possible to see movement in about 30 days with the right steps. Your credit score (a number ranging roughly from 300 to 850) reflects how reliably you manage debt. In the U.S., the main scoring models are FICO (used by most lenders) and VantageScore. Both weigh similar factors with payment history and credit utilization as the heaviest components. By understanding these factors and taking targeted actions, you can give your score a boost in a month.

Credit Score Basics: FICO vs. VantageScore

Your FICO Score (by Fair Isaac) is the most widely used credit score (around 90% of top lenders use it). It is calculated from five factor categories:

1. Payment History (35%)

Have you paid on time? This is the single largest factor. Even one late payment (30+ days) can significantly hurt your score.

2. Amounts Owed / Credit Utilization (30%)

How much of your available credit you’re using. Lower is better; experts recommend keeping each card under ~30% of its limit, and aiming for even single-digit percentages for top scores.

3. Length of Credit History (15%)

How long your accounts have been open (average age). Longer history usually helps, so avoid closing your oldest accounts if possible.

4. Credit Mix (10%)

Having a variety (credit cards, loans, mortgage, etc.) can help, but it’s only a small part of your score.

5. New Credit (10%)

Opening several new accounts or having recent hard inquiries can ding your score temporarily.

FICO’s breakdown is similar to VantageScore (another common model, used by some banks and apps). VantageScore 3.0/4.0 also emphasizes payment history (~40%) and credit utilization (~20%), plus factors like the depth of your credit (age and variety) and recent credit (new accounts). In practice, the same basic rules apply: pay on time, keep balances low, and don’t open or close too many accounts at once. For example, one blog notes VantageScore counts payment history at 40 to 41% and utilization at about 20%.

Tip: Small business owners should pay extra attention to their personal credit. Lenders often use a business owner’s personal credit to make loan decisions. A high personal score can unlock better business financing terms.

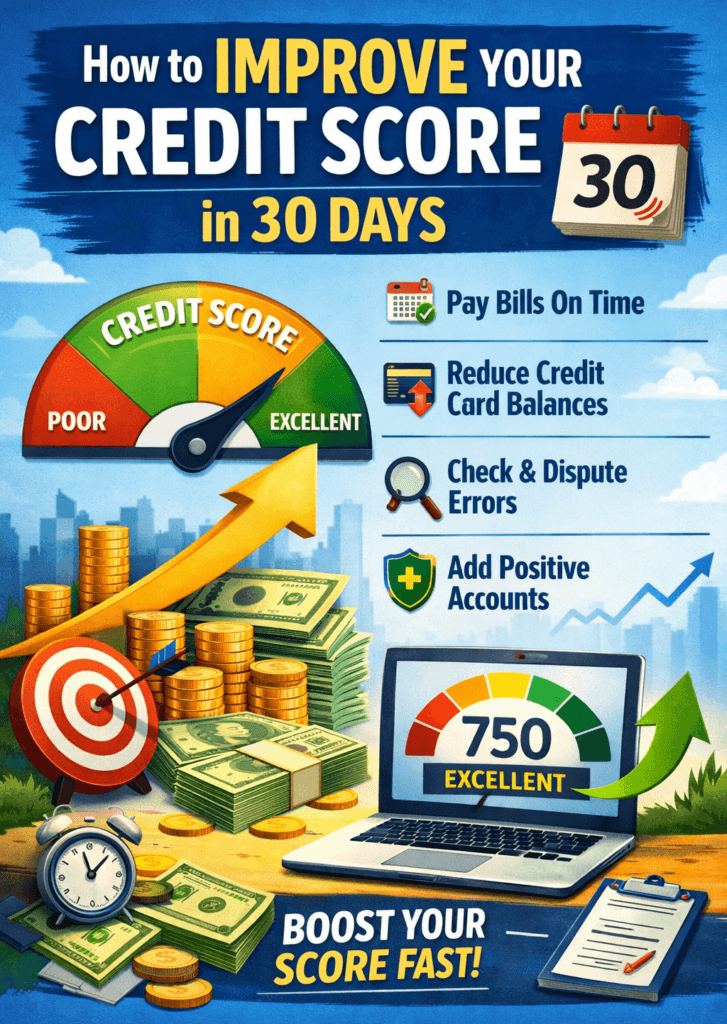

30 Day Credit Boost Strategies

Improving your score in a month means targeting quick wins and “low-hanging fruit” while laying groundwork for longer-term habits. Below are proven strategies, many of which credit experts say can begin to move your score in 30 days. Use a combination of these approaches, and track your progress with free credit monitoring apps as you go.

1. Pay All Bills on Time (and Catch Up on Overdue Payments)

Payment history is the single most important factor, so never miss a due date. If you have any late payments, bring them current immediately. After paying an overdue bill, contact the creditor and politely ask if they will remove the late mark from your credit report. If you’ve otherwise been punctual, some creditors may agree to a “goodwill” deletion of a one-time late payment.

1.1. Set Up Autopay or Reminders

Use automatic payments or calendar alerts so you don’t miss due dates. If a payment is late by 30 days or more, it can drop your score, so catching up fast is crucial.

1.2. Prioritize Essentials

If funds are tight, focus on credit cards and loans (mortgage, auto, etc.), since those are reported to the bureaus. Utility bills often don’t report unless you default.

1.3.3 Record Improvement

Each time you pay on time, you’re reinforcing a positive record. 90% of FICO scores reward a history of on-time payments.

In a nutshell: paying on time can raise your score quickly. Credit scoring providers note it’s the most influential factor in both FICO and VantageScore systems.

2. Lower Your Credit Utilization (Pay Down Balances)

Your credit utilization ratio, the percentage of each card’s limit that you use, and are usually the second-biggest score factor. For example, if a card has a $1,000 limit and a $300 balance, its utilization is 30%. Experts recommend keeping utilization under 30% on each card, and ideally below 10% for best scores.

2.1. Pay More Than the Minimum

Target the cards with the highest balances first. Even modest extra payments can lower your utilization immediately when the issuer reports to the credit bureaus.

2.2. Make Multiple Payments

If you get paid twice a month, make a payment midway and again at month-end to keep balances low throughout the billing cycle.

2.3. Ask for Credit Limit Increases

If your income or credit history has improved, request a higher limit on your cards. A higher limit (with the same balance) directly lowers your utilization percentage. Make sure the issuer uses a “soft” inquiry to avoid a score dip.

2.4. Use Any Windfalls

Tax refunds, bonuses, or gifts can be used to slash card debt and utilization.

Keeping utilization low can show benefits almost immediately. As soon as your next credit report updates with lower balances, your score calculation will use the improved (lower) ratio. In practice, people with top scores usually keep their utilization in the single digits.

3. Check Your Credit Reports and Dispute Errors

Even a single error on your report can hold back your score. Common mistakes include incorrect late payments, accounts that aren’t yours, or debts that should have fallen off (old collections, bankruptcies). Use the free government site AnnualCreditReport.com to download your Equifax, Experian, and TransUnion reports at no cost.

3.1. Look for Inaccuracies

Read each report carefully. Check that payments marked late are correct, and that your personal information and account statuses match your records.

3.2. Dispute Mistakes Immediately

If you see an error (like a wrongly reported late payment), file a dispute with the credit bureau. You can do this online for free. Explain the mistake and provide proof (like payment receipts). Bureaus typically have 30 to 45 days to investigate.

3.3. Clear Old Debts

Verify that debts older than their reporting period (usually 7 years for most negatives) are removed. If not, dispute them as well.

Fixing errors can yield a fast boost. NerdWallet notes that disputing credit report errors can help you quickly improve your credit. For example, if a wrongful 30 day late is deleted, your score can jump substantially.

4. Use Credit Wisely and Add Positive Accounts

Don’t close old accounts. The age of accounts matters, so if you pay off a credit card, it’s usually better to keep it open (but unused) to preserve your history length. Also avoid opening many new accounts in a short time, as too many inquiries can pull your score down temporarily.

4.1. Become an Authorized User

If possible, ask a trusted relative or friend to add you as an authorized user on their credit card with a long history of on-time payments. You don’t have to use the card just being listed will usually add their good history to your credit profile. Most major cards report authorized-user status to all bureaus. Newbies to credit can see a big impact from this trick.

4.2. Open a Secured Credit Card

A secured credit card requires a cash deposit (your limit equals the deposit), but it functions like a regular card. By using it responsibly and paying on time, you build positive history. Experian notes secured cards can help you build credit if the issuer reports to the bureaus. Keep utilization on the secured card low (aim below 30%) and pay the balance in full each month. Many banks also offer the chance to convert a secured card to an unsecured card after good use, which further boosts history length.

4.3. Report Rent and Utility Payments

Traditionally, rent and utility payments don’t show up in credit reports. However, services like Experian Boost let you add on-time utility, phone, and streaming payments to your Experian credit file for free. Some rent-reporting services can similarly add rent payments to your credit profile. Including these payments won’t remove any negatives, but for someone with no or limited credit, it can add positive data and bump your score.

4.4. Mix of Credit

If you only have one type (say all credit cards), consider adding a different account. For example, taking a small credit-builder loan (some banks offer them specifically to build credit) or a new credit card (opened sparingly) can improve your “credit mix” over time. Note: opening a new account does cause a hard inquiry and temporarily adds recent credit, so only do this if you have a plan to manage it responsibly.

5. Use Credit Monitoring and Financial Tools

Staying informed is key. Credit monitoring apps and services can alert you to changes and help you track your score as you implement improvements. Many are free and user-friendly:

5.1. Credit Karma

A free service that provides your TransUnion and Equifax VantageScores and offers tips on what’s helping or hurting you. It also suggests credit cards and loans you might qualify for.

5.2. Experian App

Lets you see you’re Experian FICO® Score for free, along with your Experian credit report and personalized alerts. It also offers Experian Boost (utility payments) within the app.

5.3. TransUnion App / CreditWise

Capital One’s CreditWise (by TransUnion) gives your TransUnion VantageScore and alerts about your credit file, plus tools to simulate how changes affect your score.

5.4. Other Apps

There are many (MoneyLion, Credit Sesame, IdentityForce, etc.) that provide similar free scores and monitoring. The key is to pick a reputable one (check reviews) that shows regular updates.

Using these tools helps you catch issues and see the impact of your actions immediately. For example, once a credit card payment posts and reports, you can watch your utilization ratio drop and your score tick up. Many of these apps also send alerts if a new account is opened in your name or if your score changes suddenly, so you can respond quickly to potential fraud.

6. Additional Tips and Small Business Considerations

6.1. Deal with Collections

If you have debt in collections, paying it off can remove a big negative, especially under newer scoring models. Many newer FICO versions and VantageScore ignore paid collections, so as soon as a collection agency reports a paid status, your score can rise. Even negotiating a “pay for delete” (agreeing to pay if the agency removes the account from your report) is worth exploring, though results vary.

6.2. Avoid “Quick-Fix” Services

Be wary of any service promising a 100-point jump in 30 days. Legitimate score gains come from the actions above, not gimmicks. Consistency is key; credit bureaus update reports monthly or weekly, but building creditworthiness is a marathon, not a sprint.

For small business owners, remember that personal credit affects business financing. According to experts, your personal score is a snapshot of how you manage money and will heavily influence business loan approvals and terms. All of the strategies above apply: paying bills on time and keeping balances low will not only help your personal score, but also improve your credibility with lenders.

By following these steps over the next 30 days and beyond, paying down debt, staying current, monitoring your progress and you can start to see your credit score move in a positive direction.

Conclusion

Focus first on timely payments and lowering credit card balances, as these have the fastest impact. Check your credit reports for errors and dispute any you find. Consider adding positive items like a secured card or authorized-user account, and take advantage of tools like Experian Boost or rent reporting if applicable. Set up credit monitoring to keep yourself informed.

Improving your credit isn’t magic it’s about consistent, responsible habits. But even small, smart changes can start showing results in about 30 days. A higher credit score can save you money on loans and open doors (especially for small business owners seeking financing), so it’s worth the effort. Start today by making a payment plan: pay off one balance and ensure you have autopay set for next month. Each positive step moves you closer to better credit health.

Be patient and persistent

Continue to pay every bill on time, use credit wisely, and check your progress regularly. Over time, your score will improve further. Good credit habits not only raise your score but also they demonstrate financial responsibility, which pays off in better loan rates and more opportunities in the future.

Financial Disclaimer

The information provided on this blog is for educational and informational purposes only and should not be considered financial, investment, tax, or legal advice. All content is general in nature and may not apply to your individual circumstances.

While we strive to keep the information accurate and up to date, we make no warranties or guarantees regarding completeness, reliability, or accuracy. Any actions you take based on the information on this blog are strictly at your own risk.

Before making any financial decisions, you should consult a qualified professional who can consider your specific goals, income, risks, and personal situation.

Frequently Asked Questions

Can I really improve my credit score in 30 days?

Yes, many people can see changes in about 30 days, especially if the improvement comes from lowering credit card balances (utilization) or correcting errors on a credit report. Results vary based on what’s currently hurting your score and when lenders report updates to the bureaus.

How many points can my credit score go up in a month?

There’s no guaranteed number. Some may see small changes (a few points), while others can see larger jumps if they fix a major issue (like an incorrect late payment) or significantly reduce utilization. The size of the change depends on your starting profile and what changes on your credit report.

When do credit card payments show up on my credit report?

Most issuers report once per month, often around the statement closing date. Your score may update after the bureau receives the new balance information, which can take several days.

Does paying the minimum payment help my credit score?

Paying at least the minimum helps you avoid late payments (which protects your score). However, carrying high balances keeps utilization high, which can still hold your score down. For faster improvement, pay down balances aggressively.

Will checking my credit score lower it?

Checking your own score through a bank/app or pulling your own credit report is typically a soft inquiry and does not hurt your score. A hard inquiry (from applying for new credit) can temporarily lower your score.

Should I open a new credit card to improve my score quickly?

Usually not for a 30 day goal. New credit applications can cause a hard inquiry and reduce the average age of accounts. A new card might help utilization if it adds available credit, but it’s not guaranteed and can backfire short-term.

Does closing a credit card improve my credit score?

Often, no. Closing a card can reduce your total available credit, increasing utilization, and may affect your credit history profile. Keeping older accounts open (with low or no balance) can be better for your score.

Can becoming an authorized user help in 30 days?

It can, especially for people with thin credit files. If the primary cardholder has a long, positive payment history and low utilization, and the issuer reports authorized users to the bureaus, your credit profile may improve after reporting updates.

What should I do if my credit report has an error?

Dispute it immediately with the credit bureau(s) reporting the error and provide documentation. Corrections can improve your score if a negative mark (like a late payment) is removed.

Does paying off collections increase my credit score?

It depends on the scoring model and how the account is reported. Some newer scoring approaches may treat paid collections less negatively than unpaid, and removing/settling collections can help your overall credit profile. A “pay for delete” arrangement (if available) can have a bigger impact because it removes the listing, but it’s not guaranteed.

Is a secured credit card good for rebuilding credit quickly?

Secured cards can help rebuild credit if the issuer reports to the bureaus and you keep utilization low and pay on time. They’re most useful if you need to add positive payment history because you can’t qualify for unsecured cards.