For nearly one-third of Americans, having no emergency fund means even a minor crisis could spell financial trouble. In fact, about 24% of Americans report having zero emergency savings. Living paycheck-to-paycheck is common, and many would struggle to cover an unexpected $400 expense without going into debt. Building an emergency fund is crucial for financial preparedness, especially for young professionals facing uncertain job markets and rising costs.

However, the challenge is real: Americans’ saving rates have plummeted in recent years, falling to under 5% of their income in 2024 (down from 32% in 2020). With inflation and high living expenses, setting aside money can feel daunting. The good news is that many people are determined to save 79% of Americans planned to grow their emergency funds in 2025 indicating a widespread desire for financial security.

Below, we outline 10 proven strategies to help you grow your emergency fund. These emergency savings tips ranging from budgeting hacks to using modern apps will empower you to build a safety net step by step. Let’s dive into practical ways to boost your emergency savings and achieve greater financial peace of mind.

1. Set a Clear Savings Goal (Know Your Target)

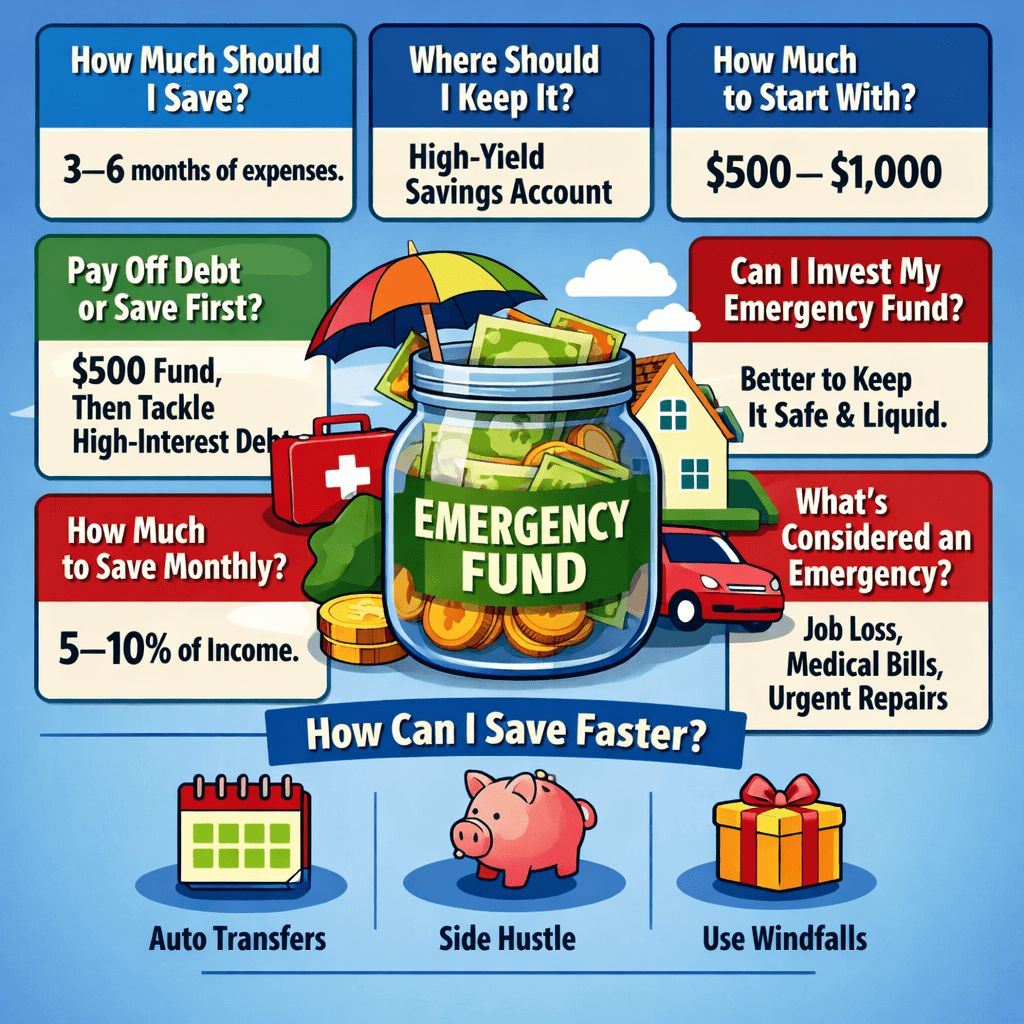

The first step is knowing how much you need in your emergency fund. Financial experts often recommend saving enough to cover 3 to 6 months of living expenses. For example, if your monthly bills are about $2,000, you’d need roughly $6,000 saved to have a three-month safety net. This ensures you could handle a job loss or major unexpected bill without derailing your finances. While 3 to 6 months’ worth of expenses is a common rule of thumb, tailor your goal to your situation if you’re self-employed or have irregular income, you might aim for the higher end (or even more). Conversely, if you have a very stable job or other forms of support, you might lean toward the lower end.

If the full target seems overwhelming, start with a smaller milestone. Even having a cushion of $500 or $1,000 can cover many minor emergencies (consider that nearly 30% of Americans cannot afford a mere $400 surprise expense). The important thing is to set a concrete goal and work toward it. Break it into mini-goals if needed (e.g. “save $500 by June,” then “reach $1,000 by September”). Having a clear target whether it’s $3,000, $10,000, or more gives you something specific to strive for and helps you measure your progress along the way.

2. Pay Yourself First by Budgeting for Savings

One of the most effective emergency savings tips is to pay yourself first. This means treating your savings like a mandatory bill in your budget. As soon as you receive your paycheck, allocate a portion to your emergency fund before paying any other expenses. By making savings a non-negotiable line item, you ensure it happens regularly. In practice, this could mean deciding that, say, 10% of each paycheck or a flat $200 a month goes straight into your emergency fund.

Building it into your budget this way is crucial, yet surprisingly few people do it fewer than 15% of Americans include an emergency fund contribution in their monthly budget. Don’t be part of that statistic. To get started, create a monthly budget (try the 50/30/20 rule, where 20% of your income goes toward savings and debt). Identify an amount you can comfortably save each pay period and treat it like a bill that gets “paid” to your savings account. You can use budgeting tools or apps to help with this (for instance, You Need A Budget (YNAB) encourages users to assign every dollar a job, including dollars toward an emergency fund goal). By prioritizing savings in your budget, you essentially promise that money to yourself. The result: you consistently grow your fund instead of just saving whatever is left (which often is nothing).

3. Automate Your Savings Contributions

Once you’ve decided how much to save, make it automatic. Removing the need for willpower or remembering transfers will dramatically increase your success in growing your emergency fund. Set up an automatic transfer so that on each payday (or monthly), a predetermined amount of money moves from your checking account to your emergency savings account. Many employers can even split your direct deposit for example, 90% of your paycheck to checking and 10% directly to a savings account so you never “see” the money you’re saving. The idea is to make saving happen in the background.

Very few people take advantage of automation only about 12% have set up automatic monthly contributions to their emergency fund which means there’s a huge opportunity for you to gain an edge. Automating turns saving into a “set it and forget it” task. You can also use specialized apps or bank features to micro-save: for instance, some banking apps will round up your everyday purchases to the nearest dollar and sweep the spare change into savings for you. Over time, those little round-ups and scheduled transfers add up significantly. By automating, you ensure that your fund grows consistently without any extra effort or temptation to skip a month. It’s one of the simplest ways to build momentum in your emergency fund.

4. Keep It Separate in a High-Yield Savings Account

Where you keep your emergency fund matters. To maximize growth and minimize temptation, open a separate, high-yield savings account dedicated to your emergency fund. Don’t commingle this money with your everyday checking or general savings you’ll be less likely to dip into it for non-emergencies if it’s out of sight and earmarked for a special purpose. In fact, most Americans recognize this: 56% keep their emergency savings in a separate account from their regular savings. By doing the same, you create a psychological barrier that protects your fund from impulse spending.

Equally important, a high-yield account helps your money grow on its own. High-yield savings accounts (often offered by online banks or credit unions) pay considerably more interest than standard savings accounts. This means your emergency fund earns money while it sits there. For example, some online savings accounts offer around a 2% annual percentage yield, versus the national average of about 0.4% APY for savings. That difference is significant over time, higher interest can boost your balance with zero extra deposits on your part.

When choosing an account, prioritize liquidity and safety: an FDIC-insured savings or money market account is ideal because your money is secure and accessible without penalties. Online banks are great for this, as they tend to have high yields and low (or no) minimum balances. By keeping your emergency fund separate and in a high-yield account, you’ll be less tempted to spend it and benefit from extra growth through interest. It’s truly a win-win for building your fund faster.

5. Trim Expenses and Redirect the Savings

Another proven strategy to grow your emergency fund is to free up extra money in your budget by cutting expenses, then funnel those savings straight into your fund. Many young professionals find there isn’t much “left over” to save that’s where expense reduction comes in. Take a close look at your spending and identify areas where you can cut back. Many Americans struggle here; about 35% say high monthly expenses are a top barrier keeping them from saving for emergencies. By lowering those expenses, you remove a key obstacle.

Start by tracking your spending for a month (your banking app or a budgeting app can help categorize where your money goes). Then, target some of these opportunities to trim the fat:

5.1. Subscription services

Cancel or downgrade subscriptions you don’t use enough. Do you really need all those streaming platforms or that pricey gym membership? You might save $50 or more per month right here. (Tip: Apps like Rocket Money can help identify and cancel unwanted subscriptions for you.)

5.2. Bills and utilities

Shop around for better deals on things like your cell phone plan, internet service, or insurance policies. Often a quick call to your provider or using a comparison tool can lower these bills. Even negotiating rent or refinancing a loan at a lower rate (if you have high-interest debt) can free up cash flow that you can divert to savings.

5.3. Food and entertainment

Limit how often you dine out or order takeout, and cook at home a bit more. Meal planning and buying groceries with a list can save a lot. Similarly, find low-cost or free entertainment alternatives rather than expensive nights out. For instance, if you currently spend $100/week on restaurant food and drinks, try cutting that in half and you’d free up about $200 a month for your emergency fund.

Every dollar you save by cutting expenses is a dollar that can go into your emergency fund. Make it a habit that whenever you eliminate or reduce a cost, you immediately transfer the equivalent amount to your savings. For example, if you negotiate your cable bill down by $20/month, set up a $20 automatic transfer to your emergency fund each month so you truly capture that savings. These lifestyle adjustments might require some sacrifice in the short term, but remind yourself that you’re buying something important: financial security. Even relatively small changes (like bringing coffee from home instead of a $4 daily latte) can add up to hundreds of dollars a year saved. By living a bit more frugally and redirecting those savings to your emergency fund, you’ll see your balance grow faster without necessarily needing a higher income.

6. Boost Your Income (and Save the Extra Money)

Cutting costs is great, but there’s a limit to how much you can trim. To really accelerate your emergency fund growth, consider finding ways to earn more money and pledging that extra income to savings. In fact, research shows increased earnings are a major driver of bigger emergency funds people who grew their emergency savings were nearly 4x more likely to have seen a rise in income than those whose savings decreased. As one financial analyst put it, “Rising income is the most important factor… nothing compares to simply having more money to contribute”.

So how can you boost your income as a young professional? You have a few avenues:

- Negotiate a raise or seek a promotion at your current job. If you’re due for a review or have taken on more responsibilities, prepare a case and ask for that salary bump. Even a few percent increase, if funneled into savings, makes a difference.

- Overtime or extra shifts if you’re paid hourly. Temporarily taking on more work can directly increase your pay. Just be careful to balance burnout; even a short stint of extra hours with a specific savings goal in mind can be worth it.

- Side hustles and freelance work. This is a big one in the gig economy era. Think about skills or interests you have that could earn you money on the side. Perhaps you can freelance (writing, graphic design, coding, consulting), drive for a rideshare or delivery service on weekends, offer tutoring, babysitting, or pet-sitting, do yard work in your neighborhood, sell handmade crafts online, or start a small side business. Many young professionals are embracing side gigs to supplement their income. The key is, treat side income as sacred for your emergency fund don’t just add it to your spending money.

Even a modest side hustle that brings in an extra $200 a month, when consistently saved, becomes $2,400 in a year (plus any interest earned). And if you come across one-off opportunities like selling unused items around your home, or earning a bonus at work put those windfalls into your fund (more on windfalls in the next tip). By actively looking for ways to earn a bit more and dedicating those dollars to your emergency fund, you’ll reach your goal much faster. Plus, increasing your income has no ceiling in the way cutting expenses does; you might find a side hustle that really takes off. Just remember to resist lifestyle inflation if you earn more, aim to save more, not spend more. Boosting your income and channeling that extra cash into savings is one of the most powerful strategies for building financial resilience.

7. Save Your Windfalls (Tax Refunds, Bonuses, Gifts)

When you receive an unexpected or periodic lump sum of money, make it a habit to save a significant portion of it for your emergency fund. Windfalls can be game changers for your savings because they’re money you weren’t relying on for day to day expenses. Common examples include tax refunds, work bonuses, birthday/holiday gifts of cash, rebates, or even an inheritance. Instead of viewing these as fun money to spend, view them as a golden opportunity to grow your safety net.

Take the tax refund: during the 2024 tax season, the average federal tax refund was about $3,221. That’s a substantial chunk that could immediately bolster your emergency fund. In a recent survey, roughly 40% of Americans said they planned to save or invest their tax refund rather than spend it. By joining that 40% and depositing your refund into savings, you might hit your next milestone in one go. Similarly, if your employer gives an annual bonus or if you get an unexpected monetary gift, try to channel at least half (if not all) of it into your emergency fund before you do anything else.

Psychologically, it can help to treat windfalls separately from your regular income. Since you weren’t living on that money before, you won’t “miss” it when you save it. For example, if you receive a $1,000 bonus, immediately put $700 or $800 into your emergency fund and maybe reward yourself with the remaining portion. You’ll still enjoy some of it, but you’ve also made a big leap toward financial security.

Another tip: if you get a salary raise or a new, higher-paying job, try to continue living on your old budget for a while and direct the extra income into savings. For instance, if a raise nets you $200 more per month after taxes, increase your automated savings by that $200. This way, you painlessly save your raise instead of absorbing it into new spending. Windfalls and raises don’t come every day, so when they do, make them count. One or two good windfalls saved can kick-start an emergency fund that would otherwise take many months to build.

8. Try a Savings Challenge to Motivate Yourself

Saving money can feel like a slog, but gamifying the process can keep you motivated and disciplined. That’s where savings challenges come in. A popular one is the 52 Week Savings Challenge. The idea is simple: in week 1, save $1; in week 2, save $2; week 3, save $3, and so on, adding an extra dollar each week. By the final week (week 52), you put aside $52. If you complete the challenge, you will have saved $1,378 in one year (plus any interest if the money sits in an account). Not bad for starting with just a single dollar.

The magic of a structured challenge like this is that it builds the saving habit gradually. In the beginning, it’s easy anyone can save that first $1, $2, $3… As the weekly amounts increase, you’ve had time to adjust your spending and find creative ways to meet the target (by the middle of the year you’re saving around $26/week, and towards the end $50+/week). Some people do the challenge in reverse (start with $52 and decrease each week) or even randomly pick a amount each week to deposit, crossing off amounts 1 through 52 once each. Any of those variations still get you to $1,378 saved. The key is to challenge yourself and make it fun.

There are other challenges too: a “no-spend month” (where you commit to no unnecessary purchases for one month and put all that unspent money into savings), or a daily challenge like saving $5 a day for a month (which would give you about $150 by month’s end). You could also do a 3 month challenge of cutting a certain category of expense (e.g. no restaurant spending for 90 days and tally up how much you saved). Some banking apps and online communities offer interactive savings challenges or trackers that let you visualize your progress.

By turning saving into a game or a personal contest, you stay engaged and motivated. Each small win each week you complete or each goal you hit gives you a sense of accomplishment that keeps you going. At the end of the challenge, not only will you have a nice chunk of money added to your emergency fund, but you’ll also have strengthened your saving habits. Remember, though, that these challenges are meant to supplement your regular savings plan (not replace it). So you can do a 52 week challenge on top of your automated transfers, for example, to turbocharge your progress. Try a challenge and see if it inspires you might be surprised how quickly those small amounts accumulate.

9. Leverage Financial Tools and Apps to Save More

Modern problems require modern solutions, and thankfully there are many apps and tools that make saving money easier than ever. As a tech-savvy young professional, you can put these tools to work for you and take a lot of the manual effort out of saving. Here are a few types of tools (and examples) to consider:

9.1. Budgeting Apps

A good budgeting app helps you track expenses, stick to your spending plan, and identify extra money to save. For example, Mint is a free app that aggregates all your accounts, tracks your transactions, and shows where your money is going. You Need a Budget (YNAB) is another popular tool (subscription-based) that uses zero-based budgeting it forces you to allocate every dollar of income to something, including an emergency fund category. By diligently budgeting, you may discover you do have money each month that can be diverted to savings (perhaps you notice you’re spending $100 on subscriptions you forgot about that’s $100 that could go to your fund). Some apps even let you set specific savings goals and will show your progress visually, which can be very motivating.

9.2. All-in-One Money Management

Certain apps combine budgeting with automated saving features. Rocket Money (formerly Truebill) is one such app. It not only helps you track your bills and spending, but can automatically transfer spare money into a savings account for you based on your goals. Rocket Money will also identify subscriptions you’re paying for and let you cancel them easily (or even negotiate bills down on your behalf), potentially freeing up more cash to save. These comprehensive apps act like a personal finance assistant keeping an eye on your money and nudging it into savings whenever possible.

9.3. Automatic Savings Apps

If you struggle with the discipline of saving, let an app do it for you. Digit (recently rebranded as Oportun) is an app that analyzes your income and spending patterns, then automatically moves small amounts into a savings account so you don’t even notice it. It might round up your purchases to the nearest dollar and save the change, or withdraw a few dollars on a day it predicts you can afford it. The idea is your savings go on autopilot and it works; you’ll accumulate a “hidden” stash surprisingly fast. Other apps and services offer similar micro-saving features, or you can use your bank’s tools. Setting up these automatic sweeps can effortlessly boost your emergency fund without you having to make active decisions each time.

9.4. Cashback and Coupon Apps

Another way to grow your emergency fund is to save money on the money you spend and channel those savings to your fund. Apps like Ibotta and Rakuten give you cash back for everyday purchases. Rakuten, for example, lets you earn a percentage back when you shop through their links at over 3,500 retailers (often 1 to 10% of your purchase) and doesn’t require you to buy specific items. Ibotta offers rebates on groceries and other products by scanning your receipt. Over a year, the cashback you earn could be hundreds of dollars which you can then transfer into your emergency savings. There are also coupon and deal apps, as well as browser extensions that automatically apply coupon codes when you shop online. Using these won’t directly deposit money into your emergency fund, but they reduce the cost of your purchases, effectively freeing up cash.

By leveraging these tools, you take a lot of the heavy lifting out of saving. They can help you find money to save (through budgeting insights or discounts) and actually save it for you (through automation and round-ups). Many of these apps are either free or have free versions, and a few dollars a month for a paid app can be worth it if it helps you save much more. Explore what works for you maybe you start by using Mint to get a handle on your budget, then add Digit to quietly siphon little bits into savings, and use Rakuten when shopping for necessities. Each tool strengthens your ability to grow that emergency fund. The ultimate goal is to make saving easy and habitual, and apps can be terrific training wheels for that.

10. Stay Consistent and Protect Your Fund from Dip-Into Temptations

The final strategy is more of an ongoing mindset: be consistent and disciplined about your emergency fund. Building the fund is one challenge; maintaining it for true emergencies is another. It’s important to keep your eye on the prize and resist the temptation to dip into your emergency savings for non-emergencies. This can be tough life is full of temptations and gray areas (“I really want to go on that weekend trip, maybe I can borrow from my emergency fund and pay it back later…”). But raiding your fund defeats its purpose. In fact, many people struggle with this: 65% of millennials have admitted to dipping into their emergency savings to cover ordinary living expenses, essentially using up their safety net because of budget shortfalls. Try not to let your fund become a revolving account that you tap for day-to-day needs or impulsive buys.

To protect your emergency fund, put some speed bumps in place. We already mentioned keeping it in a separate account (possibly at a different bank) with no debit card attached. That alone creates a barrier to spend that money, you’d have to deliberately transfer it, which gives you time to reconsider. You could also nickname the account “Emergency Only” in your online banking, reinforcing its purpose. Some people even put their emergency savings in a bank that isn’t easily accessible instantly (like one that takes a couple of days to transfer out) so they aren’t tempted to use it for impulse purchases. Do what works for you to draw a clear line: this money is off-limits unless it’s a real emergency.

Equally, remember that consistency is key in growing your fund. Treat saving for your emergency fund as an ongoing habit, not a one-time project. Continue your monthly or weekly contributions, even if they are modest. Over time, thanks to the power of consistency and compound interest, your fund will keep reaching new highs. Track your progress and celebrate milestones to stay motivated for example, when you hit your first $1,000 saved, give yourself a pat on the back (or do something inexpensive to celebrate, like a movie night at home). Then set your sights on the next milestone ($5,000? $10,000?). Some folks find it encouraging to watch their savings grow via a graph or chart over time; most banking apps will show your balance history, or you can use a simple spreadsheet.

Finally, be prepared to use it when truly needed that’s what it’s there for. If an emergency does strike (your car breaks down, you have an unexpected medical bill, you lose your job, etc.), you can face it with far less stress because you have this financial cushion. Yes, your emergency fund might drop when you use it, but using it beats going into high-interest debt or not being able to pay your bills. Afterward, make a plan to rebuild the fund back to your target. Life can be unpredictable, but by staying consistent in good times and using discipline in challenging times, you’ll keep your emergency fund healthy.

Conclusion

Growing an emergency fund takes time and commitment, but every step you take makes you more financially secure. As a young professional, starting these habits now will pay off tremendously throughout your life. Stick with these strategies automate your savings, live slightly below your means, increase your contributions as you earn more, and keep your hands off the cookie jar (emergency money) except for true emergencies. Before you know it, you’ll have built a robust emergency fund that gives you peace of mind and confidence to handle whatever life throws your way. That feeling of financial safety is worth every effort you put in today. Good luck, and happy saving.

Financial Disclaimer

The information provided on this blog is for educational and informational purposes only and should not be considered financial, investment, tax, or legal advice. All content is general in nature and may not apply to your individual circumstances.

While we strive to keep the information accurate and up to date, we make no warranties or guarantees regarding completeness, reliability, or accuracy. Any actions you take based on the information on this blog are strictly at your own risk.

Before making any financial decisions, you should consult a qualified professional who can consider your specific goals, income, risks, and personal situation.

Frequently Asked Questions

What is an emergency fund, and why do I need one?

An emergency fund is money set aside specifically for unexpected events job loss, medical bills, urgent car repairs, or emergency travel. It prevents you from relying on high-interest credit cards or loans when life happens. Surveys consistently show that many Americans still have little to no emergency savings, which increases financial stress and debt risk.

How much should I save in my emergency fund?

A common benchmark is 3 to 6 months of essential expenses (housing, utilities, food, insurance, minimum debt payments). If your income is variable (freelance/commission) or you have dependents, consider 6 to 12 months.

Should I invest my emergency fund in stocks or crypto?

Usually, No. Emergency funds need stability and quick access. Stocks/crypto can drop in value right when you need the money. If you want to invest, do that separately after you have a solid emergency cushion.

How much should I save each month?

A practical starting point is 5 to 10% of take-home pay, or a fixed number (like $50 to $200 per paycheck). The best amount is the one you can sustain consistently then increase it after raises, bonuses, or debt payoff.

How much should I start with if I’m broke or living paycheck-to-paycheck?

Start with a “starter emergency fund” goal of $500 to $1,000. That’s often enough to cover smaller surprises and keep you from going into debt, then you can build toward 3 to 6 months.